A large-scale crisis in the cost of living in the UK threatens to completely stop the growth of the national economy. Consumers and businesses are expected to rein in spending as taxes rise and inflation rises to 10%. With this in mind, the maximum that can be achieved in terms of production in the fourth quarter is hardly much higher than the data of the last quarter of 2021.

In a report released on June 8, the association of manufacturers of Great Britain said the economy was barely holding its ground in the second and third quarters and would even shrink slightly in the last three months of the year. In general, for 2023, GDP will grow by only 0.6%, which is much lower than the official forecast from the Bank of England.

The UK is increasingly at risk of falling into a recession as rising prices reduce household living standards and increase the cost to companies and their employees.

The Organization for Economic Cooperation and Development (OECD) echoed the producers' associations in confirming that growth risks stalling next year as consumer spending shrinks in the face of higher prices. The OECD and the International Monetary Fund say that the UK is facing the highest and most persistent inflation among the industrialized countries of the G7.

Price overpressure

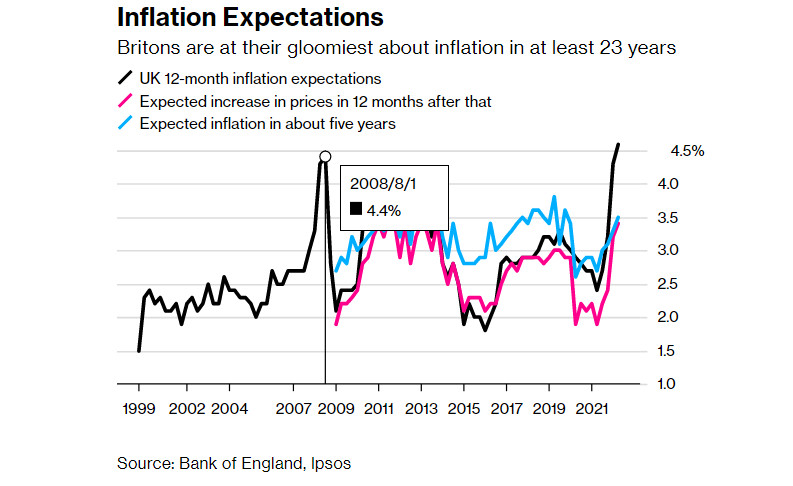

Inflation reached a 40-year high of 9% in April, and it is expected that this level has not even reached the peak that will traditionally fall in October, when a further sharp increase in electricity bills is predicted.

Consumers surveyed in May expected in-store prices to rise 4.6% over the next 12 months. This figure rose from 4.3% in February and 2.4% a year ago.

Even after five years, inflation is expected to be at 3.5%, well above the 2% target.

Overall, more than three out of every four British adults are concerned about the rising cost of living, with low-income and vulnerable people expressing the greatest concern. 77% of people over the age of 16 are "very or somewhat concerned" about an inflationary shock, according to an Office for National Statistics poll following the rise in electricity prices in April. And 68% of those who are concerned report that they are already spending less on essentials.

All this leads to a drop in demand for goods from British manufacturers. In this regard, bankruptcies in the British economy have intensified.

Although the overall insolvency rates of companies and entrepreneurs in the first three months of this year were about the same as in 2021, the overall picture is much worse if we exclude the smallest firms and companies that were liquidated during the solvency period.

Insolvency filings more than doubled in the first quarter, according to the bankruptcy office, with preliminary guidance data for April showing a 21% year-on-year increase. And this trend is unlikely to subside as rising energy and material costs make life difficult for British businesses.

Nearly 1,900 UK companies were in financial distress at the end of March, up 19% from a year earlier, according to another private study.

Consumer spending and business investment are also expected to rise less than previously forecast this year and remain flat in 2023.

The chairman of the association expressed great concern about the state of the industry on the island.

Nevertheless, the Bank of England is more than resolute so far.

What is worth is only one statement by finance minister Rishi Sunak, that none of the British banking institutions has grounds to demand state aid in the event of a crisis.

The statement did not come out of nowhere. Before that, eight major financial institutions, including HSBC Holdings plc, Lloyds Banking Group plc, and Barclays plc, conducted a traditional self-assessment of assets.

The so-called solvability estimate is published for the first time. The Bank of England ordered lenders to check themselves in 2019, but the original publication deadline was delayed due to the Covid outbreak. The assessment will be repeated in 2024 and then every two years.

Each firm must submit a report showing how the all-important segments—lending and taking deposits—could continue if the firm failed. The settlement rules are there to give the authorities or new management the time they need to restructure or liquidate the firm.

In its report, for example, Barclays said that the separation of its retail banking from investment banking has simplified the group and reduced the likelihood that customers and clients will be exposed to a disruption elsewhere in the company or company turmoil.

Obviously, the Bank of England took into account not only the experience of 2008, when taxpayers paid billions of pounds to support organizations such as the Royal Bank of Scotland. As far as I understand, two pandemic years of ultra-soft policies, when banks were swimming in cheap loans, were also taken into account. These finances, as in 2008, almost completely leaked to the financial markets of secondary and speculative instruments, having little effect on the financing of real production.

This was partly a consequence of the quarantine, because the enterprises themselves requested fewer loans, because they were not sure of the ability to work fully in the face of restrictions and the threat of another wave of the epidemic.

And yet, there is a feeling that the British Treasury has finally realized the need for targeted or at least intra-sector assistance specifically to manufacturers.

It is also quite logical in terms of reducing the debt burden on the British, who are now confident that their taxes will not be used to pay out insane dividends to shareholders or bonuses to bank management.

The seriousness of the central bank's intentions is confirmed by the clearly stated position that even if the bank needs to be closed, customers will be able to continue accessing their accounts as usual.

But there is a big catch in all this.

In fact, to keep the economy going, this step should have been taken two years ago. Now the regulator's reserves are depleted, all kinds of support and development funds have long been exhausted, and the difficult six months are still ahead.

Still, better late than never.

The Bank of England expressed confidence that none of the institutions included in the review is expected to go bankrupt due to the fact that none of them is too large to bear systemic risks.

It is a bit worrying that the adjustment regimes are largely based on the experience of the 2008 crisis.

Adjustment planning for the regulator is often based on the increasingly rare assumption that the bank will fail on Friday night and that the firm and regulators can handle the fallout while the markets are closed.

British confidence in the actions of the Bank of England is steadily falling

The report showed that public confidence in the Bank of England is at an all-time low and Britons expect above-target inflation to continue for years to come.

For the first time in history, more people were dissatisfied than satisfied with the work of the central bank, according to a quarterly study of British attitudes to consumer prices, and it cannot be said that there are no grounds for this.

Along with the decline in approval, only 25% said they were satisfied with the performance of the Bank of England, respondents said they were more pessimistic about inflation than at any time since the poll began in 1999.

These results will no doubt increase pressure on Bank of England Governor Andrew Bailey and his colleagues to secure an unprecedented fifth consecutive rate hike next week. We can expect a quarter-point increase, bringing the total rate increase to 1.25%.

This is not at all good news, primarily because if people stop believing in the ability of the central bank to control consumer prices, there is a risk that they will seek higher wages as compensation, which could lead to a self-winding 1970-style inflation spiral years, which will lead to an even greater increase in the cost of living.

The rising cost of living will scare away some of the immigrants who were in England for the sake of earnings. This means that this event will be followed by their outflow, an even greater shortage of cheap labor, and the need to raise the wages of producers again.

And these are only internal economic factors. The conflict in Ukraine, in which Britain is a stakeholder and supplier of one of the parties, and the ongoing outbreaks of coronavirus in China also worsen the forecasts.

In general, the future of the British economy looks quite bleak. Obviously, the British currency will also be under attack. So, we can expect further development of the trend for the pound/dollar currency pair.