The EUR/USD currency pair continued to decline on Monday. In previous analyses, we pointed out that the euro's rise on Friday was entirely illogical and contrary to the ongoing trend. Therefore, we anticipated that Monday would see the pair "restoring fairness" once again. Over the past few months, the market has consistently adjusted the euro's exchange rate toward what is considered a fair value. Given the recent developments regarding the Federal Reserve and the European Central Bank, it is likely that this trend of adjusting to a fair value will continue for some time.

Since the beginning of the year, we have maintained that the euro is overbought and unreasonably expensive. Although we anticipated that the decline would start a bit earlier, it's important to emphasize that forecasting future exchange rates is a highly complex task. Predicting the timing of a specific movement is even more difficult. Many traders aim not only to predict the overall direction of future price movements but also to identify the exact moment they should enter the market at the start of a trend. In practice, this is rarely achieved and often resembles guesswork. However, it is possible to determine the general direction of price movement by conducting a thorough analysis of the factors influencing it.

Currently, the euro has declined by nearly 800 pips, and we continue to believe that this downtrend will persist. This trend remains intact across all timeframes, particularly the higher ones. If the long-term trend, which has been in place for 16 years, is not broken (and there are no fundamental reasons for it to be), the euro could drop below 0.95 next year. However, it's important to note that fundamentals could change, especially with Donald Trump taking office. But for now, there are no indications to suggest a shift in this trend.

On Friday, the euro corrected once again after failing to break below the 1.0355 level. Notably, this marked the third attempt to surpass this level. However, when a price repeatedly tests a level, it often indicates that a breakthrough may eventually occur. By Wednesday, both the EU and U.S. markets will observe Christmas, with Tuesday being a shortened trading day. Therefore, significant market movements are not expected today, and the market will be closed tomorrow.

Monday demonstrated that, despite it being the holiday season, the market does not remain idle. We had previously warned that the holiday week does not guarantee stagnant markets. On the contrary, movements are possible due to the "thin" market conditions. Furthermore, a downtrend persists across nearly all timeframes, and on Monday, the price rebounded from the moving average on the 4-hour chart. While Monday's movement was not particularly strong, it was entirely predictable.

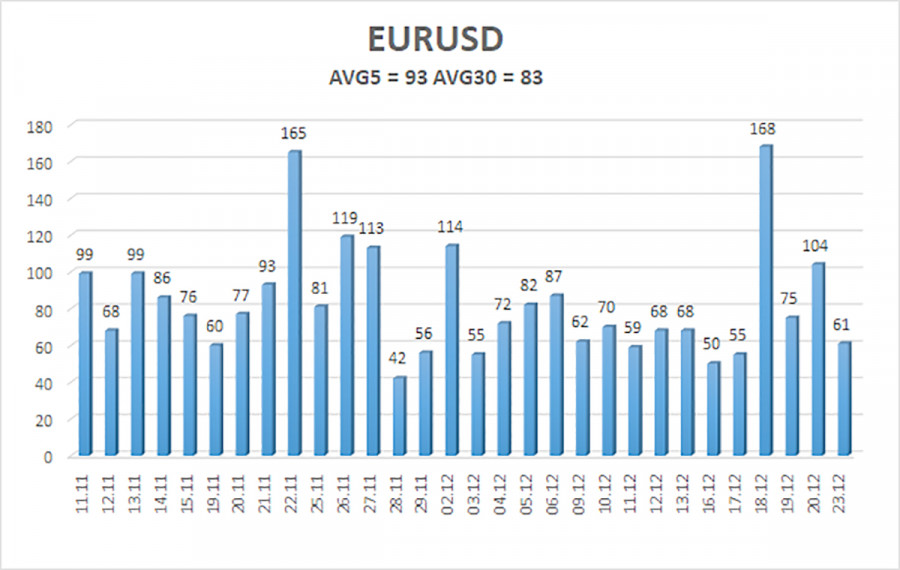

The average volatility of the EUR/USD currency pair over the last five trading days is 93 pips, which is classified as "medium." On Tuesday, we expect the pair to fluctuate between the levels of 1.0305 and 1.0491. The upper linear regression channel remains downward, indicating that the overall bearish trend continues. Additionally, the CCI indicator has entered the oversold area again amid a significant decline, serving as another warning of a potential correction.

Key Support Levels:

- S1: 1.0376

- S2: 1.0254

- S3: 1.0132

Key Resistance Levels:

- R1: 1.0498

- R2: 1.0620

- R3: 1.0742

Trading Recommendations:

The EUR/USD pair is likely to continue its downward trend. In recent months, we have consistently highlighted our expectation of a decline in the euro over the medium term, and we fully support this bearish outlook. There is a strong possibility that the market has already factored in all future Fed rate cuts, which reduces the chances of medium-term dollar depreciation, a situation that was already limited.

Short positions remain relevant, with targets set at 1.0305 and 1.0254, as long as the price stays below the moving average. For those who trade using "pure" technical analysis, long positions may only be considered if the price rises above the moving average, with a target of 1.0620. However, at this time, we do not recommend entering long positions.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.