EUR/CHF belongs to the category of "cross-pairs" and shows how many units of the Swiss national currency (franc) you need to pay for one euro, which is the legal tender of 19 countries (as of September 2020) that are members of the eurozone (Austria, Belgium, Germany, Greece, Ireland, Spain, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, Finland, France, Estonia) and the national currency of another 12 states, 7 of which are located in Europe.

The base currency in the EUR/CHF pair is the euro. This means that the commodity in the EUR/CHF pair is the euro, and the Swiss franc is the second currency in the pair, with which the base currency (the euro) is bought. The euro is included in the IMF basket, consisting of five major world currencies (in descending order): the US dollar, the euro, the yuan, the yen, and the pound sterling. At the same time, the euro and the franc are the world's reserve currencies, and the franc is considered the most stable currency in the world.

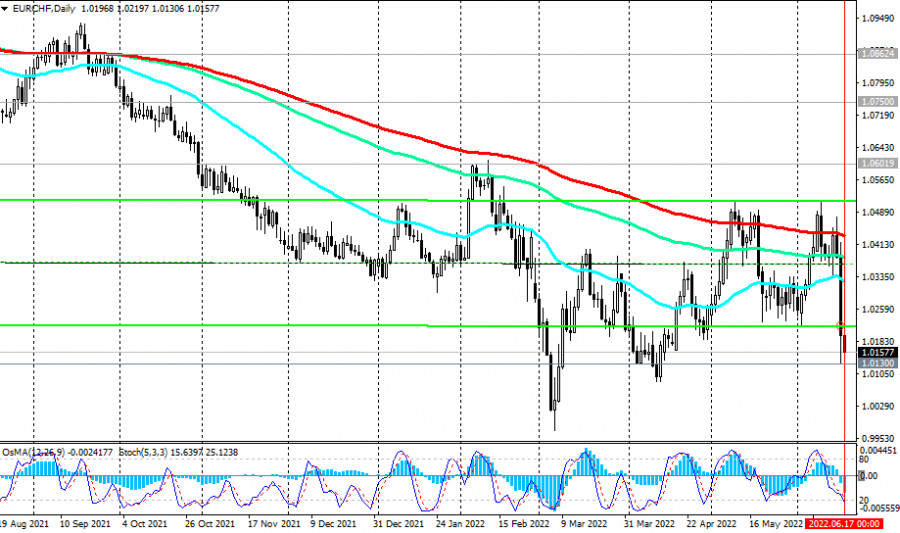

At the moment (after the meeting of the Swiss National Bank on June 16, 2022, when the central bank of this country unexpectedly raised the key interest rate on deposits by 0.50% to -0.25%), the EUR/CHF pair is trading on the Forex market at a price below 1.0200. This means that for one euro they give less than 1.0200 francs.

Features of trading the EUR/ CHF pair

1. Both the euro and the franc and the EUR/CHF pair are characterized by high liquidity. At almost any moment, there will be both buyers and sellers for the franc or euro. The trading volumes of the EUR/CHF pair are quite high. According to various estimates, the euro accounts for slightly less than 30% of the total trading volume on the foreign exchange market.

2. Germany, whose economy is the locomotive of the Eurozone economy, at the beginning of 2020 was in 5th place in the world in terms of GDP (3.13%), while Switzerland is in 39th place (0.40%).

3. At the same time, Switzerland ranks 9th in the world in terms of GDP (according to the IMF rating) per capita, and its economy is one of the most stable in the world. The share of Switzerland in world GDP is approximately 0.40%, the share of the Eurozone is 17%.

4. The EUR/CHF pair is actively traded throughout the trading day. The highest peak of trading activity with the euro, the franc, and the EUR/CHF pair and the largest trading volumes occur during the European session (06:00 – 16:00 GMT). Moreover, the first two or three hours at the beginning of trading in London (07:00 – 10:00) are the most active in trading the EUR/CHF pair. In the period from 10:00 to 15:00 (GMT), sharp, as it seems, sometimes unreasonable, movements of the pair are often observed, and in any direction.

5. The surge in trading volatility in the EUR/CHF pair falls, in addition to the release of news of a political nature, during the publication of important macroeconomic indicators for the Eurozone, Germany, and Switzerland. The following macroeconomic factors and indicators give the greatest volatility to the EUR/CHF pair:

- Decisions of the Swiss National Bank and the ECB regarding monetary policy in Switzerland or the euro area;

- Speeches by the heads of the SNB and the ECB (currently Thomas Jordan and Christine Lagarde, respectively);

- Publication of minutes from the latest meetings of the SNB and the ECB on monetary policy issues;

- Data from the labor market of Switzerland, Eurozone, Germany;

- GDP data for Switzerland, Eurozone, Germany;

- Publication of inflation indicators for Switzerland, Eurozone, Germany

Strong macroeconomic data in Switzerland or the euro area lead to the strengthening of the franc or the euro, respectively, as they contribute to the growth of "tough sentiment" of the central banks of Switzerland or the Eurozone regarding an increase in the interest rate. And this is a positive factor for the national currency, which leads to an increase in its value.

6. Important political events in Switzerland, the euro area, and in the world also affect the quotes of currencies, and above all, the franc and the euro. The sale of assets on the stock markets of Europe leads, as a rule, to an increase in the value of the euro, including in the EUR/CHF pair. And vice versa. The growth of the stock market in the euro area, as a rule, is accompanied by a decrease in the value of the euro.

7. Although the franc has recently lost its status as a safe-haven currency due to active intervention in the trades of the Swiss central bank, it is still in active demand among investors during periods of economic or political uncertainty in the world. The franc retains a fairly strong direct correlation with the yen and gold, which have the status of safe-haven assets in the financial markets.

8. Investors still have fresh memories of when the Swiss National Bank "untied" the franc rate from the euro on January 15, 2015. The EUR/CHF pair saw a dramatic jump in volatility. In one day the EUR/CHF lost 2250 pips. In the next 4 weeks, the EUR/CHF pair "beat off" about a third of the losses, however, the EUR/CHF pair never again rose to levels near the 1.2000 mark. Currently, the EUR/CHF pair is trading near the 1.0700 mark, and the SNB periodically interferes in the trading in the foreign exchange market with the sale of the franc. In recent years, the SNB has traditionally considered the franc overbought and relatively expensive, which, according to the bank, hinders the growth of the Swiss economy and harms the country's exporters.

9. The intraday volatility of the EUR/CHF pair fluctuates in different periods of the month and year. On average, it is 65 points, but it can exceed 150 points during periods of publication of important news of a political or economic nature.

10. Many traders prefer to trade this pair at the end of the trading day and the American session. The strategy is scalping.