Despite the Kremlin's loudly expressed gratitude to the OPEC+ countries for refusing to increase the rate of oil and gas production, the markets are well aware that in fact the refusal is primarily due to the threat of a global recession, which will entail a large decrease in production rates, and hence energy consumption. But is it really worth expecting a reduction in total production by 2 million barrels per day? Let's get into the facts.

OPEC reduction – the devil is not so terrible...

So, following last week's meeting, OPEC+ agreed to cut its overall production target by 2 million barrels per day starting in November. However, it seems that so far there is more threat in their statements than real actions. This leads to a number of conclusions.

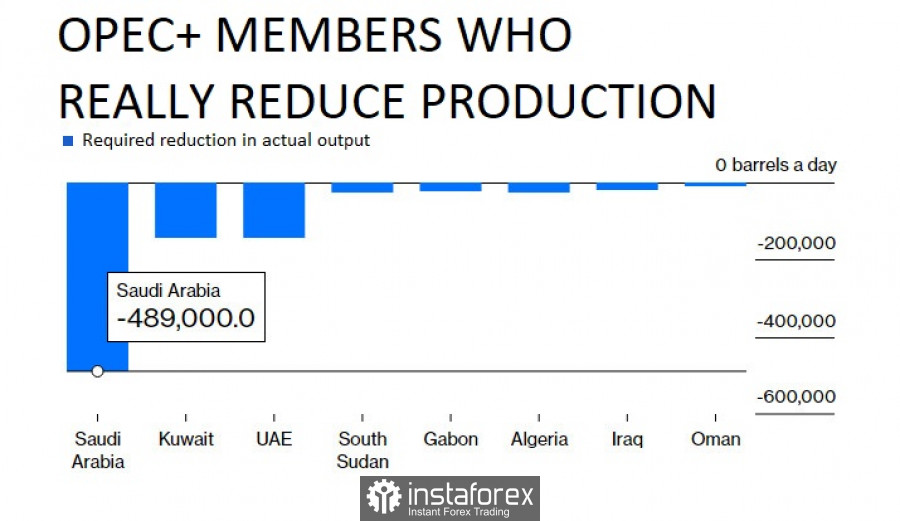

First, while there are 23 countries in the group, only three will share the burden of the latest cut – Saudi Arabia, the United Arab Emirates and Kuwait. Most others are already pumping so far below their quota levels that their performance still falls short of their new allocations. This gives hope that other countries will try to cover demand by increasing production.

Thus, the overall estimates of OPEC+ production for the previous month showed that, in aggregate, it lags behind the planned level by about 3.6 million barrels per day.

When the new targets come into effect (November 1), only eight countries will have to pump less crude oil - this will affect the three big players, as well as to some extent South Sudan, Algeria, Gabon, Iraq and Oman.

The total reduction required from them is only 890,000 barrels per day. This is still a significant reduction, but it is no longer two billion, you must agree. The official position is that the rest of the "reduction" will be repaid by refusing to increase the productivity of other participating countries.

However, don't expect the reduction to be even that big. Actually, the volumes of South Sudan, Gabon and, perhaps, even Iraq can already be removed from the equation.

OPEC's own data show that South Sudan has not only exceeded its quota monthly since the current deal came into force in May 2020, but has not reduced production by a single barrel. It would be amazing if it started now.

Gabon has shown a similar lack of resolve. According to OPEC, its production was below the limit in just one month of the 29-month history of the agreement.

As for Iraq, the country's oil minister, without even leaving the common sandbox, immediately after the deal was concluded on Wednesday, assured oil buyers that the agreement would not affect its country's exports.

This is a direct signal to remove all three from the list. In my opinion, the guys are able to take advantage of the general decline to cover the needs of manufacturers (at least partially) – at good prices. And they are not going to lose such an item of income in a heavy bear market.

We go further.

The reductions required from Algeria and Oman amount to 32,000 barrels per day, but experts say that this is a mere meager amount - nothing more than a rounding error in the estimation of the group's total production. And maybe even a big one – following the example of the same Iran.

The cuts required from Saudi Arabia and its neighbors amount to 790,000 barrels per day. This is a large figure, but even it can be fully covered by increasing the production of some other members of the group, although this is a purely theoretical conclusion, because additional volumes will require the commissioning of new production facilities.

For example, Nigeria, Angola and Malaysia are struggling with a reduction in production capacity and have been pumping below planned levels for many months. This is unlikely to change.

Russia is also struggling. It was already difficult for it to keep up with the growing production volumes of other countries before February 24, and in the months since the beginning of the conflict, the situation has only worsened.

And it's not just the lack of supplies to Europe. Russia could lower the price and reorient its capacity to Asia, which it is doing now. However, the deterioration of the equipment and the impossibility of developing new deposits force it to turn on the mode of geopolitics.

Kazakhstan also does not support the reduction situation.

Currently, production is more than 560,000 barrels per day lower than planned due to a combination of scheduled maintenance at one of the largest fields and a gas leak at another. Completion of the work this weekend should allow the return of about 260,000 barrels per day. The rest will take time, but the country's energy minister says that volumes will return before the end of the month — just in time to compensate for the planned reduction.

If everything goes according to plan, you can safely focus on an "impressive" reduction in production to 230,000 barrels per day. It seems hardly worth worrying about.

And even this reduction will not affect the overall state of the economy too much, since the recession will force producers to retreat, which means they will consume less. Therefore, all we will come to in the end is to keep oil prices at the current level (other things being equal).

It should also be taken into account that in a month everything can change.

European Union sanctions on Russian oil exports come into force on December 5 — the day after the producers' group is due to hold its next meeting. These restrictions apply to most maritime supplies to the bloc's members, which have already fallen to about 660,000 barrels per day from 1.6 million barrels in January.

This seems to be just a logical continuation of the story, which the markets have already taken into account, since Russia has successfully redirected most of the crude oil that European buyers avoided to India, Turkey and China.

But sanctions, which are also aimed at restricting supplies to non-European countries, may have a much greater impact due to secondary factors.

In particular, Russia's own tanker fleet is not large enough to transport all the oil that needs to be redirected from Europe. This may lead to the fact that the storages will be clogged again, and then we should expect a reduction in production.

The proposed limit on Russian oil prices would provide the Kremlin with a way out — exemption from sanctions for those cargoes that are sold at a price that has not yet been agreed or lower — but Moscow seems determined not to go for it, at least not for European consumers, which means that the volume of energy trade will still fall.

Could the Kremlin decide to stop production instead of agreeing to a price cap? If it were possible, OPEC reduction by 2 billion barrels a day is not such a fairy tale... but raw materials still make up the main revenue part of the Russian budget. On the other hand, the financing of armed conflicts under sanctions, including the mobilization currently being carried out on the territory of the Russian Federation, will require additional costs. Obviously, this is not an option for the Kremlin at all.

Taking into account all the facts, a loud statement about the largest reduction in energy production by OPEC looks like a way to keep prices at the reached highs, which is not so easy ahead of a recession, rather than a new reality.