Analysis of Thursday's Trades:

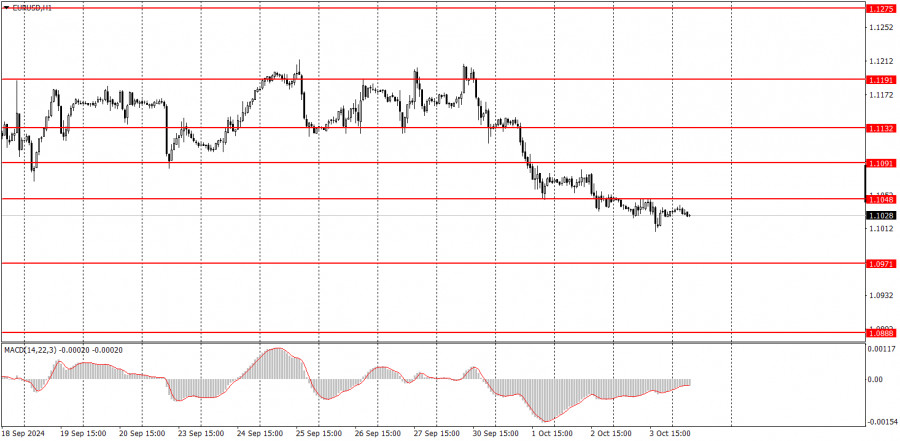

1H EUR/USD Chart:

On Thursday, the EUR/USD currency pair continued its moderate decline. Over the past two days, volatility has decreased, which may suggest the market is waiting for the final reports of the week—the most important ones. These include the unemployment rate and NonFarm Payrolls. However, even on Thursday, macroeconomic data supported the U.S. dollar. Recall that since the beginning of the week, the dollar has received several growth factors daily, which hasn't happened in a long time. Yesterday, the ISM Services PMI for September exceeded the forecast by about 3 points. Thus, the dollar had every reason to strengthen yesterday but showed weak growth. Given all the supportive data, we believe the decline observed since the start of the week is too weak. The uptrend is likely over, but it's important to remember that the dollar has fallen consistently for the past two years. In the medium term, the euro's illogical buying may still resume.

5M EUR/USD Chart:

The movements were almost entirely flat in the 5-minute time frame on Thursday. As shown in the illustration above, the pair traded between the levels of 1.1011 and 1.1048 throughout the day. The price rebounded from both boundaries of this local range. Therefore, novice traders could open short positions first, followed by long positions. Both trades ended in profit, but the gains were small, as volatility on Thursday was not exceptionally high.

How to Trade on Friday:

In the hourly time frame, the EUR/USD pair still has the potential to form a downward trend; this week, it has made a significant step in that direction. Unfortunately, erratic dollar selling could quickly resume in the medium term, as no one knows how long the market will continue to factor in the Federal Reserve's monetary easing while ignoring all the elements that favor the dollar. However, over the past couple of weeks, it has been noticeable that market participants are finding it harder to push the pair further upward. We might be nearing the end of the uptrend, but some crucial reports are yet to be released this week, which could change everything.

On Friday, trading can be done from the levels of 1.1011 and 1.1048. However, today, several key U.S. reports will be released, which could potentially be weak and trigger another dollar decline.

In the 5-minute time frame, consider trading from the levels of 1.0726-1.0733, 1.0797-1.0804, 1.0838-1.0856, 1.0888-1.0896, 1.0940, 1.0971, 1.1011, 1.1048, 1.1091, 1.1132-1.1140, 1.1189-1.1191, 1.1275-1.1292. On Friday, no significant events are scheduled in the Eurozone, but in the U.S., reports on unemployment, wages, and the labor market will be released.

Basic Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

- If two or more trades were opened near a particular level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate a lot of false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trades should be opened during the period between the start of the European session and the middle of the US session, after which all trades should be manually closed.

- In the hourly time frame, it's preferable to trade based on MACD signals only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are very close to each other (between 5 and 20 pips), they should be treated as a support or resistance zone.

- After a trade has moved 15 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Price Levels: These levels serve as targets when opening buy or sell positions. They can also be used as points to set Take Profit levels.

Red Lines: These represent channels or trend lines that display the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): The histogram and signal line serve as an auxiliary indicator that can also be used as a source of trading signals.

Important Speeches and Reports (always found in the news calendar) can significantly impact the movement of a currency pair. Therefore, trading should be done with maximum caution during their release, or you may choose to exit the market to avoid a sharp price reversal against the preceding movement.

For Beginners Trading on the Forex Market: It's essential to remember that not every trade will be profitable. Developing a clear strategy and practicing money management is key to achieving long-term success in trading.