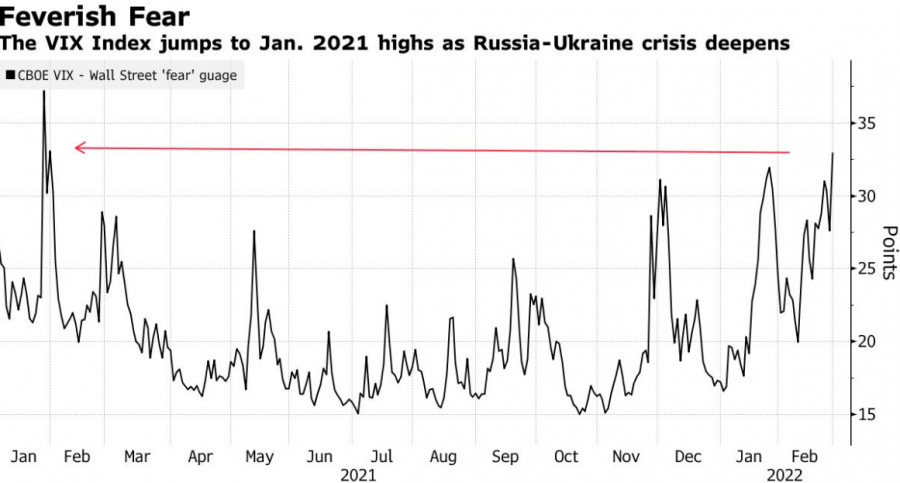

Russia's intensifying invasion of Ukraine has sent investors rushing for cover. The volatility index has hit the highs of 2021.

The Cboe Volatility Index, the "fear gauge" for the S&P 500, jumped to the highest on a closing basis since January 2021. To protect oneself from the consequences, analysts recommend buying so-called stocks and currencies - safe havens. Among equities, utilities are of interest, for example, which are not directly linked to how the economy is performing. Among currencies, the Asian region, the dollar and the Canadian currency are popular.

Europe's worst conflict since World War II has sent investors rushing for cover in havens such as the dollar, gold and US Treasuries. While Ukrainian and Russian officials are set to begin talks Monday, traders are cautious about dipping their toes into stocks given the escalating risks.

The US and Europe have kicked some Russian banks out of the critical SWIFT financial messaging system and that's sent the ruble to fresh all-time lows, prompting the Bank of Russia to raise its key interest rate to the highest in almost two decades.

However, the implications extend far beyond Russia. Rising oil prices are adding to inflation pressures, increased defense spending hurts economies just coming out of Covid-19. All of this could affect the Federal Reserve's plan to raise interest rates more quickly to curb inflation, even as the military conflict in Ukraine has affected North America the least.

"We expect a period of high volatility and higher equity risk premia," said Patrick Moonen, principal multi-asset strategist at NN Investment Partners. The firm cut its exposure to cyclical stocks as commodity price-driven sustained high inflation could weigh on the growth outlook, he said.

Despite the fact that the Russian central bank suspended stock trading in Moscow for the day, traders are selling whatever they can, rushing to get rid of shares in Sberbank and other sanctioned companies. The VanEck Russia ETF, a US-listed fund that tracks the country's stocks, lost more than a quarter of its value Monday in US premarket trading.

Back at the weekend it became known that Plc would get rid of its stake in Rosneft PJSC. Despite this, analysts see little chance of attracting a buyer. The British company has warned that it could write off up to $25 billion in losses if it pulls out of Russia.

BP Plc shares plunged as much as 7.5% Monday, the most in three months.

Among stocks with heavy Russian business exposure, tiremaker Nokian Renkaat Oyj lost almost a quarter of its value and Austria's Raiffeisen Bank International AG declined as much as 19%.

From utilities to telecommunications, defensive stock sectors have outperformed this year along with the dollar index, signaling mounting worries that the Russia-Ukraine war will curb economic growth.

Generali Investments, for example, is cutting its overweight position on value while adding defensive and quality names. Morgan Stanley analysts upgraded utilities to overweight and downgraded automotives to equal-weight.

Future contracts tracking the S&P 500 slumped as much as 2.9% before paring the advance to trade 1% lower in the wake of the benchmark index's hefty gains on Friday. If the selloff gathers pace it could dip back into correction levels, defined as 10% drop from its recent peak. However, this scenario is not yet the most popular among analysts.

Spot gold prices have soared in February as investors sought safer investments. Bullion is just shy of hitting the highest level since December 2020.

"The Russian invasion of Ukraine fits into the unknown unknown box, along with most geopolitics," said Michael Wilson, a strategist at Morgan Stanley. "While there are many people who know quite a bit about such matters, geopolitics are very difficult to analyze and therefore very difficult to price. Instead, this invasion simply adds another risk to the mix that's unlikely to disappear quickly."

Indeed, every day there is news from Ukraine and Moscow that changes the outlook. The recent nuclear threat from the Kremlin has not yet created a significant resonance among politicians. However, the Europeans are likely to press their governments to do more to minimize this possibility. So it is reasonable to expect another pool of sanctions, which has the potential to cause severe economic consequences, primarily for Russia itself, but for the world economy as well.

On the other hand, it is unlikely that European citizens will overlook the obvious threat. We should expect rallies in the euro zone, as well as another sanctions.

The negotiations that have just ended are not likely to satisfy the parties, even with a formal agreement, which would then suffer the fate of the Minsk agreements.